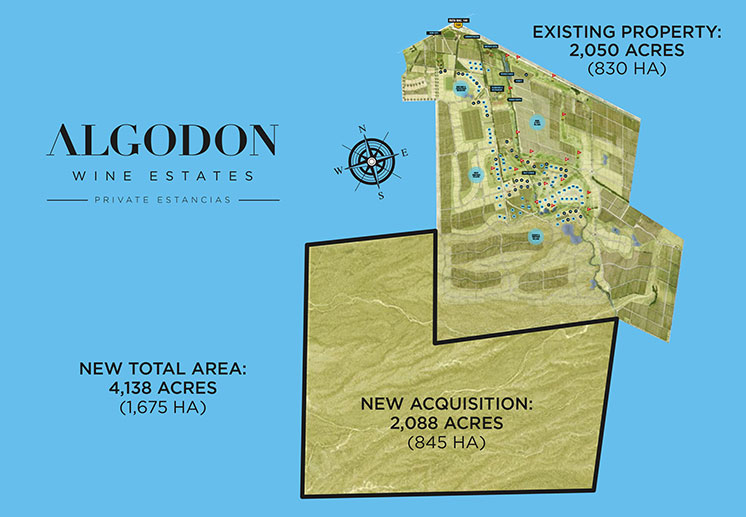

Purchase of More Than 2,000 Acres Doubles the Size of Algodon Wine Estates & Expands Long-Term Revenue Opportunity

Source: Algodon Wines & Luxury Development Group

8/25/2017

NEW YORK, NY – August 24, 2017 – Algodon Wines & Luxury Development Group, Inc. (OTCQB: VINO), a real estate development brand with luxury lifestyle assets and premium wines in Argentina, has completed the strategic acquisition of additional land directly adjacent to the existing Algodon property. The new parcel measures 845 hectares or 2,088 acres, more than doubling the size of Algodon Wine Estates.

This new land, which is on the Southwest end of the existing estate, brings Algodon Wine Estates to a total of 4,138 acres, providing room for continued expansion and growth. Algodon is considering various use cases for the new land, including the development of Private Estancias, Vineyard Villas and additional estate lots. An expansion of vineyard operations and the development of supplementary agricultural revenue streams are also being considered.

"As part of our previously announced growth strategy, our team in Argentina has been exploring under-valued assets that we can monetize in conjunction with the rising economy in Argentina,” said Scott Mathis, Founder, Chairman and CEO. “Today’s acquisition announcement is the first of many initiatives we are implementing that will expand our real estate holdings and drive future revenue growth opportunities for Algodon.

“The new land encompasses a massive 6.5 square miles and lies adjacent to our existing Algodon Wine estates property. We believe the new fertile property gives us the flexibility and space needed to expand the scope of our operations, enabling us to capitalize on the rebounding Argentinian real estate market. In fact, in the most recent quarter the city of San Rafael in the Mendoza Province lifted the prohibition on the digging of water wells, which we believe may have a significant positive impact on our parcel's value. We look forward to providing further updates to our shareholders on the development of this new land,” concluded Mathis.

Algodon Wine Estates is a 4,138 acre (1675 ha) world-class wine, wellness, culinary and sport resort, and luxury real estate development, located in the rolling hills of the Sierra Pintada Mountains in San Rafael, Mendoza, Argentina. This wine and golf community is a global destination that includes approximately 400 lots ranging from .5 to 7 acres, with 109 lots from Phase 1 of the master plan currently available for private sale and development. Surrounded by the natural beauty of vineyards, fruit orchards and olive groves, many lots have pre-existing vines and groves, and a significant number of available Phase 1 lots are situated directly on the estate’s 18-hole golf course, offering golf, vineyard and mountain views. The luxury destination is truly unique in the world, where residents can step right outside their front door onto the golf course and find themselves among meticulously manicured vines planted in the 1940s.

Recent momentum with the economic turnaround in Argentina was evidenced during the Argentina Business & Investment Forum held in September 2016 by President Mauricio Macri and the Argentina Investment and Trade Promotion Agency. The forum highlighted investment opportunities, attracted foreign direct investment and marked Argentina’s historical return to international markets. Foreign direct investment pledges post the investment forum have totaled more than $32.5 billion with Siemens & GE committing to over $15 billion in combined infrastructure projects.

In the wake of Argentina’s recent economic reforms, the Buenos Aires Herald reports that the city’s real estate market has experienced its strongest monthly growth in sales since the inauguration of President Mauricio Macri. Real estate transactions in August were up 43.9% for the same month last year, and up 18.4% from July. Experts believe that a key factor in a successfully booming real estate cycle may be linked to the increased use of mortgages, which is on the rise in Argentina. According to a February 2017 report from Morgan Stanley here, Argentina seems poised for a turnaround, one that offers investors long-term opportunity and returns.

The Argentine real estate market is traditionally notable for its all cash transactions, and Algodon Wine Estates is one of the few real estate developments in the country that provides financing for the sale of its lots pursuant to Argentine law. This is reflected in the latest data from the College of Notaries of the City of Buenos Aires, which reported that in April, 4032 deeds were executed with an average value of us$ 144,535, growing 20.5% compared to the same month of 2016; So far this year 14,985 deeds were already signed, with an increase of 45.5% compared to 2016.

According to the College of Notaries, there was also a strong rebound in mortgage lending operations. According to the entity's report, 804 of the 4032 deeds were made through this modality, with a year-on-year increase of 120%. The total amount reached in these operations is us$ 2.11 billion, a figure that reflects a year-on-year growth of 135.1%. Money tax amnesty also had an impact.

In the province of Buenos Aires, April 2017 was also the best April since 2011. According to the College of Notaries of the province of Buenos Aires, 8,920 deeds were made in April, 5.9% more than the 8,420 operations carried out in April 2016. Considering the first 4 months of this year, 27,972 operations were carried out in the province of Buenos Aires, 16.7% more than the 23,965 deeds signed in the first 4 months of 2016. Century 21 Real Estate most recently in June of 2017 announced its expansion in South America with the addition of CENTURY 21 Argentina.

Algodon Wine Estates currently operates an award-winning wine-themed real estate development and resort with an 18-hole vineyard golf course that plays through the vines, a professional tennis center with the only grass courts in the Mendoza Province, as well as seven clay courts and one hard court, and a restaurant and members’ clubhouse. The vineyard property also includes the world-class winery responsible for producing Algodon’s collection of internationally award-winning wines, as well as 325 acres (131 ha) of vineyards, with old vines dating back to 1946, which is instrumental in the winery’s ability to produce Malbec wines of the highest international caliber.

Nestled in the southern heart of Argentina wine country, Algodon Wine Estates was recently named one of the world's best vineyard hotels by Frommer's Travel Guide, and one of the world's best wine resorts by Departures Magazine. Most recently the wine estates won the 2016 Vineyard of the Year for San Rafael by Luxury Travel Guide and was also rated by Architectural Digest as one of the world’s most Beautiful Hotel Gardens. Algodon Wine Estates’ Master Plan model and Brochure can be viewed in person at Sotheby’s International Realty’s office in New York City and Buenos Aires.

About Algodon Wines & Luxury Development Group (Algodon Group)

In building our luxury brand ALGODON®, one of prestige, distinction and elegance, we begin with a focus on the quality and reputation of our award-wining wines. Algodon Wines ultimately serve as our ambassador, as we then identify and develop vineyard operations, luxury lifestyle properties, and other real estate assets and opportunities. Our company has a passion for seeking outstanding opportunities, with the potential for growth, in spectacular settings. As we continue to produce the ultra-fine wines for which we have become recognized, we expect that our reputation for quality will only continue to grow and accordingly increase the value of our company’s brand and real estate holdings. Algodon’s non-leveraged, luxury assets serve as our mainstay and are currently concentrated in Argentina, which we believe represents one of the most undervalued investment sectors in the world today. For more information, please visit www.algodongroup.com.

Cautionary Note Regarding Forward-Looking Statements

The information discussed in this press release includes “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). All statements, other than statements of historical facts, included herein concerning, among other things, planned capital expenditures, future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other plans and objectives for future operations, are forward looking statements. These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “will,” “continue,” “potential,” “should,” “could,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and are not (and should not be considered to be) guarantees of future performance. Among these risks are those set forth in a Form 10-K filed on March 31, 2017. It is important that each person reviewing this release understand the significant risks attendant to the operations of Algodon. Algodon disclaims any obligation to update any forward-looking statement made herein.

Media and Investor Relations:

Algodon Group

Rick Stear

Corporate Communications & Marketing Manager

212.739.7669

rstear@algodongroup.com

MZ Group

Chris Tyson

Managing Director – MZ North America

Direct: 949-491-8235

chris.tyson@mzgroup.us